AI

The AI revolution has not only begun, but it's also firing on all cylinders. It's a very real trend that won't fade away and is still early days. While in college, many of my friends were doing AI, I got interested in business and finance, but it's never too late. So, to get my feet wet, I started with the 60 days of AI challenge. I touched upon many things without going into depth in anything particular. During that time, I realised, I still have work to do to understand a research paper.

I made some cool things meanwhile:

- Know Your Term Sheet for founders to understand the term sheet offered to them; it's a simple prompt that you can use your favourite LLM to get you started

- Ask Buffett & Munger for investors to be able to ask questions to Warren Buffett and Charlie Munger, just like they do during Berkshire Hathaway's annual meetings; it's a Retrieval Augmented Generation (RAG) app which uses all the publicly available data on Warren Buffett, Charlie Munger and Berkshire Hathaway

- ListenThis AI which converts blog posts to audio files, embed them into the article/post itself so that readers can choose to listen instead of read it; found a paid customer

I experimented with a few more things on how to use AI for publicly listed company analysis, but unfortunately, I can't share more about it right now.

My main goal was to learn and make some side projects to implement the stuff I was learning. I soon realised I needed to revisit some basics of Linear Algebra, Probability, Numerical Computations and Machine Learning before I am in a position to read and understand research papers. I bought & read the book: Hands-on LLMs by Jay Allamar which proved to be very helpful. Only after I focused on the fundamentals could I read and understand research papers. I was thrilled. I wanted to get comfortable applying ML concepts and practice a few things on scikit-learn. While traditional ML concepts are useful, I didn't want to spend too much time there. I wanted to know just enough to reach the next step, Deep Learning. I am learning Deep Learning more thoroughly since it is the backbone of Large Language Models. Sebastian Raschka's book on Scikit Learn and PyTorch significantly helped me. Finished the CS231n and started with CS224n. After which, I should be ready to dig deep into the current state-of-the-art stuff. I also made a public instagram page @ai.bauva.by.pranit to play with AI-generated images and videos of myself. It's something fun to do on weekends, you know.

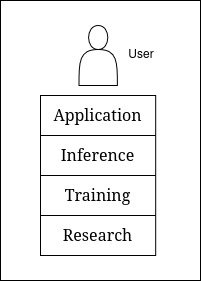

AI layers

I am most interested in the app and inference layer of this stack. A lot of value is going to accrue in these layers. That doesn't mean I can skip the training and research layers entirely. I still got to understand them just enough to make the most out of the app and inference layer, which means I still need to spend some time on it and understand how the kitchen cooks the meal before I deliver it to the table.

Business/Finance

Exiting a mid-cap private bank

If you see some of the previous annual reports, I have mentioned a certain private bank I had been bullish on, which I have exited from my portfolio. It has a low Return on Equity (RoE) which means it had to keep raising more equity capital to fund its growth of loan book because of Capital Adequacy Ratio requirements, amongst other things set by RBI. I had known that before I invested. What I didn't understand when I invested was the incentive structure. The founder & CEO had an extremely low (<1% stake) in the bank. He freely distributed his stock among people who had helped him while he kept issuing himself stock options. IMO, his incentives were structured so that if he creates a large bank, he would keep getting ESOPs. He didn't care about dilution as much as the rest of the shareholders. I still think he could be successful in creating a large bank, which would be essential for India's growth. Still, unfortunately, as a shareholder, I wasn't being compensated for it. I still might do some trading in that stock at a later date.

Unpopular Large Cap strategy working well

I have written about my Unpopular Large Cap strategy I am pleased to inform you that it is working well. It also aligns with my personal goals while producing market-beating returns. I tend to keep this strategy an integral part of my portfolio.

Understanding customer mindset

I wrote an article on the Customer mindset while buying motorcycles v/s cookers. While I have been subconsciously doing this for some time, I have been paying increasing importance to this. I have a few more of such articles I shall be writing soon.

Learning forensic accounting and spotting frauds

As I get more involved in small & mid caps, learning to do forensic accounting and spotting fraud becomes increasingly essential. It's rare to see such things in large caps, but they are quite rampant in small & mid caps. As I get more into small/mid caps, being unable to do this could land me in trouble. I read the book Financial Shenanigans which has been quite helpful. I tested my understanding of some proven frauds, and I could spot some frauds that I think others will spot after some time. I don't intend to do exposes, and I would prefer to keep that knowledge to myself. I have heard Warren Buffett claim that if he doesn't understand the financial statements, it's because the management team doesn't want him to understand it. Before this year, I never had the confidence to claim this. Now, I can somewhat claim it, although it's better to work more on this to be thorough.

Formulating a strategy for small & mid caps

A significant part of my portfolio has been in large caps until now because I could effectively articulate and use my competitive edge. While I am still trying to figure out my competitive edge in small and mid-caps, one thing is sure: understanding customer behaviour is more critical in small/mid-caps than in large caps, and so is forensic accounting. It's critical to create outsized returns while avoiding the terrible drawdowns successfully in small-caps and mid-caps. I also need to turn over many rocks to find that shining diamond.

Writing

I built the UI & design of this website by writing the CSS myself before vibe-coding used to be a thing. I can make functional websites, but they don't look as pretty. I decided to change that, and my friend xypnox helped make this website super pretty. A professional touch goes a long way in great design. Vibe-coding can probably make functional websites, but professional designers and frontend engineers can make a website go from "cute" to "fuck WOW".

I also decided to write more articles with some consistency. You should expect even more articles in the coming year. I also integrated a newsletter software MailerLite, which is kickass. It's super simple, has clean pricing, and does the job well. I recommend it to anyone who wants to send email newsletters.

Next Plans

I plan to go more deeply into AI and catch up with the current research papers. Also, I would like to understand more about how people buy, choose what to buy, and how they are influenced to buy.

Oh, and I would like to buy some GPUs this year. I have never owned any, but I don't want to be stuck sucking my thumb while watching the AI revolution happen before my eyes.